Yuhan Corporation, established in 1926, is one of South Korea’s most prominent pharmaceutical companies. With a storied legacy centered on innovation and social responsibility, the company has made significant strides in research, development, and global expansion. In this in-depth article, we analyze Yuhan Corporation’s business operations, key products, financial standing, and strategic outlook—all with the aim of helping potential investors make informed decisions.

Company Overview

Yuhan Corporation was founded by the late Dr. Ilhan New, a visionary entrepreneur and philanthropist who believed that a healthy nation could reclaim its sovereignty. Rooted in the philosophy of “contributing to the country and its people by making the best-quality products,” this guiding principle continues to shape Yuhan’s operations today.

Boasting a global network of subsidiaries and operations in Uzbekistan, Vietnam, Hong Kong, and Australia, Yuhan focuses primarily on:

- Research, development, manufacturing, and marketing of primary and specialty care pharmaceuticals

- Dietary supplements and consumer healthcare products

- Animal health products and medications

- Contract manufacturing services for active pharmaceutical ingredients (APIs)

Main Products & Services

1. Active Pharmaceutical Ingredients (APIs) and Intermediates

Yuhan is a leading provider of APIs and intermediates covering a wide range of therapeutic areas, such as antivirals, antibiotics, antihistamines, and antidiabetics. Its proficiency in API manufacturing serves both domestic and international clients, reinforcing its robust global footprint.

2. Finished Pharmaceutical Products

The company offers an extensive portfolio of finished pharmaceutical products targeting various health conditions, including hypertension, coronary artery disease, hyperlipidemia, and cerebral thrombosis. These products reach diverse patient populations under multiple brand names, showcasing Yuhan’s versatility.

3. Custom Synthesis Services

Yuhan provides custom synthesis services for pharmaceutical and biopharmaceutical companies, delivering comprehensive support from R&D to full-scale commercial production. This “one-stop solution” approach enables other companies to leverage Yuhan’s drug development and manufacturing expertise.

4. Consumer Healthcare Products

Beyond prescription medications, Yuhan produces and markets consumer healthcare products such as dietary supplements, household products, and animal care offerings. This segment adds diversification to Yuhan’s revenue channels and broadens its consumer reach.

5. Flagship Product: Leclaza (lazertinib)

Leclaza is a groundbreaking third-generation epidermal growth factor receptor tyrosine kinase inhibitor (EGFR-TKI) for treating non-small cell lung cancer (NSCLC). It has shown remarkable efficacy and safety in clinical trials:

- Superior Performance: Demonstrated better outcomes compared to existing treatments

- Historic FDA Approval (August 2024): Approved in combination with Johnson & Johnson’s Rybrevant as a first-line treatment for EGFR-mutated advanced lung cancer

- Blockbuster Potential: Analysts project annual sales could surpass KRW 1 trillion (approximately USD 678.9 million), establishing Yuhan as a formidable force in oncology

The success of Leclaza is set to enhance Yuhan’s revenue and cement its leadership in cutting-edge oncology therapies.

Growth Strategy

Yuhan’s growth strategy is a multi-pronged approach aimed at sustainable expansion:

1. Investing in Research and Development

The company is committed to boosting its R&D investments, targeting 14% of revenue to fuel innovation. This investment strategy has already yielded products like Leclaza and fosters new drug candidates in Yuhan’s pipeline.

2. Open Innovation

By collaborating with universities, research institutions, and biotech firms, Yuhan accesses novel technologies and accelerates the development of new therapies. This open innovation framework was instrumental in the success of Leclaza.

3. Global Expansion

Yuhan continues to grow its international presence through strategic partnerships, acquisitions, and new subsidiaries in key markets. Yuhan USA, for instance, serves as a hub for business development in the United States, seeking promising drug candidates and breakthrough technologies.

4. Strategic Acquisitions

The company acquires businesses and technologies that complement its product pipeline and expertise. A notable example is the acquisition of Aimedbio in July 2024, strengthening Yuhan’s foothold in drug discovery.

5. ESG Initiatives

Environmental, Social, and Governance (ESG) principles underpin Yuhan’s commitment to sustainable growth. Through efforts such as the “Yuhan ESG Management Declaration,” the company aligns its operations with responsible business practices—an approach that appeals to investors who value sustainability and ethical governance.

Industry Trends

South Korea’s pharmaceutical industry is evolving rapidly, influenced by several critical trends:

1. Rising Clinical Trial Activity

South Korea has become a global hotspot for clinical trials, supported by:

- Advanced healthcare infrastructure

- Skilled investigators

- Rigorous regulatory frameworks ensuring patient safety

2. Increasing Demand for Chronic Disease Treatments

An aging population and lifestyle shifts have led to a surge in chronic diseases—cancer, cardiovascular conditions, and diabetes—driving demand for innovative treatments from companies like Yuhan.

3. Government Support

Initiatives such as the Second Comprehensive National Health Insurance Plan promote new drug development, widen patient access to innovation, and manage healthcare spending.

4. Growth in Biosimilars

South Korea has established itself as a frontrunner in biosimilars, with companies such as Celltrion and Samsung Biologics capturing global markets. For Yuhan, this wave presents both opportunities for collaboration and competition.

5. Pharmaceutical Data Protection System

Introduced in February 2024 and effective from February 2025, this system protects clinical trial data from unauthorized follow-on drug approvals during a data protection period. It aims to encourage innovation and protect intellectual property, ultimately benefiting companies like Yuhan.

Comparison with Competitors

Yuhan operates amid notable competition from both domestic and international companies:

- Celltrion: A leader in biosimilars, with Remsima (a biosimilar of Remicade) making waves in Europe and the U.S.

- Samsung Biologics: A global CDMO specializing in biopharmaceuticals, partnering with many major pharmaceutical firms

- Hanmi Pharmaceutical: Recognized for its robust R&D pipeline and global partnerships

- Chong Kun Dang Pharmaceutical: Offers a diverse product range and has a strong distribution network in South Korea

Despite this competitive landscape, Yuhan wields several advantages:

- Legacy and Reputation: A longstanding history and strong brand credibility

- Focus on Innovation: Demonstrated by Leclaza’s development and an emphasis on R&D

- Global Reach: Strategic international expansions and partnerships

- Social Responsibility: ESG-driven practices that resonate with modern investors and consumers

Analysis of Financial Statements

| Year | Revenue (KRW) | Net Income (KRW) | EPS (KRW) | P/E Ratio |

|---|---|---|---|---|

| 2023 | 1,858,983.76 | 182,632 | 2,175.60 | 53.23 |

| 2022 | 1,775,846.94 | 229,266 | 2,824.84 | 42.38 |

As of January 31, 2025, Yuhan’s market cap stands at USD 6.37 billion. In 2023, the company posted:

- Revenue: KRW 1,858,983.76

- Net Income: KRW 182,632

- EPS: KRW 2,175.60

- P/E Ratio: 53.23

While a detailed assessment requires full financial reports, these figures suggest Yuhan is on a steady financial footing, reflecting a healthy revenue stream and profitability.

CEO & Employee review

Cho Wook-je has served as Yuhan Corporation’s CEO since 2021. A Korea University graduate with a background in agricultural chemistry, Cho has spent his career in the pharmaceutical sector and remains deeply aligned with Yuhan’s founding ethos of social responsibility.

- Leadership Philosophy: Rooted in Dr. Ilhan New’s principle of contributing to society by reinvesting corporate profits

- ESG Commitment: Under Cho’s leadership, Yuhan declared its ESG Management focus, emphasizing sustainable growth and transparent governance

- Vision: “Great & Global”

- Aims to build a “great company” that serves society

- Aspires to be a “global company” advancing global health

- Encourages open communication and an “open mind” culture for innovation and inclusivity

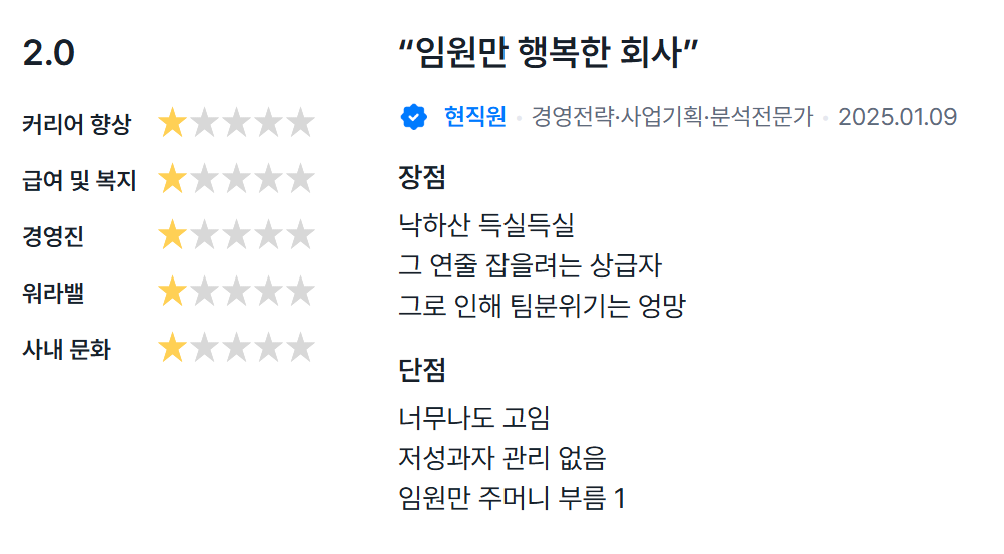

Pros

- Too many of parachute appointment

- Superiors are eager to leverage their connections.

- As a result, the team atmosphere is chaotic.

Cons

- The company is overly dominated by upper management.

- There is no proper management of underperformers.

- Favoritism is prevalent, with only executives receiving special treatment.

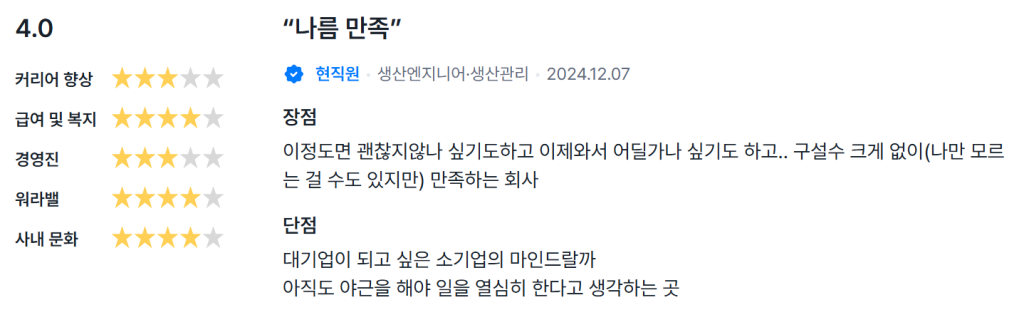

Pros

- It seems pretty good.

Cons

- It has the mentality of a small company that aspires to be a large corporation.

- They still believe that working overtime is the only way to show you’re putting in hard work.

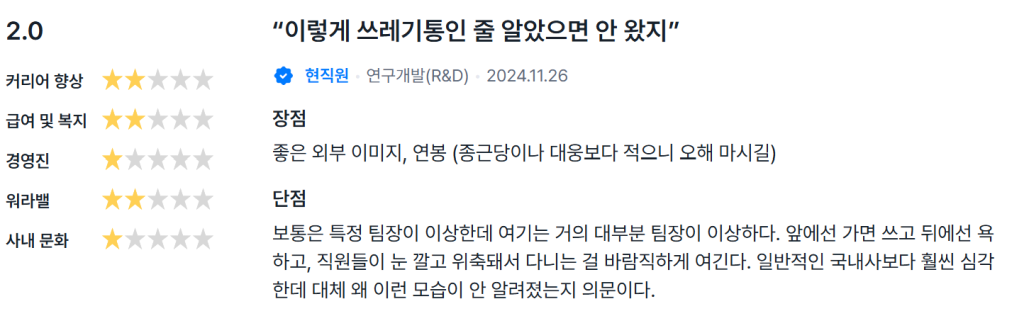

Pros

- Good external image; salary (although it’s lower than other companies)

Cons

- Typically, only certain team leaders are problematic, but here almost all team leaders are. They put on a mask in front of you and talk behind your back, and they seem to consider it acceptable for employees to be intimidated and walk around with their heads down. This issue is much more severe than what is normally seen in domestic companies, and I wonder why this behavior hasn’t become more widely known.

Recent News

Several notable announcements and milestones have brought Yuhan into the spotlight:

- FDA Approval of Leclaza (August 2024): A landmark moment for Yuhan and the South Korean pharmaceutical industry, as Leclaza received FDA approval to be used with Johnson & Johnson’s Rybrevant.

- European Commission Approval (January 2025): Leclaza again made headlines with European Commission approval, further broadening its market potential.

- Termination of Fourth-Generation EGFR Inhibitor Collaboration (September 2024): Yuhan ended its partnership with Janssen Biotech for a next-generation cancer drug, citing the strong efficacy of Leclaza.

- Supply Agreement with Gilead Sciences (September 2024): Yuhan will supply APIs for Gilead’s HIV treatments, expanding its global partnerships.

- Co-promotion Agreement with Bayer Korea (January 2025): Joint domestic promotion of Bepanthen Ointment and Canesten skin treatments, increasing Yuhan’s footprint in consumer healthcare.

SWOT Analysis

Strengths

- Robust R&D Capabilities: Proven by Leclaza’s successful development

- Established Market Presence: Strong brand recognition and legacy in South Korea

- Global Expansion: Partnerships, acquisitions, and subsidiaries in major markets

- Social Responsibility & ESG: Reinforcing a trustworthy, ethical brand image

- Experienced Leadership: Clear vision and strategic direction under CEO Cho Wook-je

Weaknesses

- Reliance on Leclaza: Future growth may hinge heavily on this blockbuster product

- Limited Financial Transparency: More granular data is needed for thorough financial analysis

- Global Competition: Larger multinational companies boast deeper resources

- Organizational Culture: Potential hierarchical structure may slow decision-making

Opportunities

- Diversification & New Therapeutic Areas: Beyond the domestic market and existing portfolio

- Biosimilar Market Growth: Capitalizing on South Korea’s leadership in biosimilars

- Increasing Chronic Disease Prevalence: Meeting rising global demand for advanced treatments

- Open Innovation: Accessing external expertise to expedite drug development

- Digital Transformation: Harnessing new technologies for operational efficiencies

Threats

- Intense Global Competition: Competition from established and emerging pharma entities

- Regulatory & Pricing Pressures: Particularly in South Korea’s government-driven healthcare system

- Economic & Geopolitical Risks: Potential market downturns and international tensions

- Environmental Challenges: Climate change and sustainability concerns affecting supply chains

- Reputation Risks: Product safety issues or litigation could harm financial performance

Investment Recommendation

Yuhan Corporation stands out as a compelling investment opportunity in the pharmaceutical sector, bolstered by:

- Strong R&D Capabilities & Innovation

- Global Reach & Strategic Partnerships

- Positive Market Response to Leclaza

- ESG Commitment & Responsible Business Practices

Actionable Advice

- Review Financial Reports: Examine Yuhan’s official filings for a clearer understanding of profitability and revenue drivers.

- Monitor Global Expansion: Keep an eye on partnerships, drug approvals, and new acquisitions.

- Assess Industry Dynamics: Pay attention to regulatory shifts, pricing frameworks, and competitive activities.

- Diversify Investments: As with any single-stock holding, consider portfolio balance to mitigate risks.

Conclusion

Yuhan Corporation exemplifies the synergy of innovation, social responsibility, and forward-thinking leadership. From pioneering cancer therapies like Leclaza to its global expansion initiatives, the company’s milestones underscore its potential for sustained success. While challenges such as reliance on blockbuster products and competition from industry heavyweights persist, Yuhan’s strategic direction and commitment to ESG principles position it favorably in an ever-evolving pharmaceutical landscape.