As of June 20, 2025, the following information is up to date based on official data from the Social Security Administration (SSA) and reputable news sources.

Social Security payments are a lifeline for millions of Americans, providing financial support to retirees, disabled individuals, and survivors. As of June 20, 2025, several updates have been implemented, including changes to the payment schedule, a cost-of-living adjustment (COLA), and the significant impacts of the Social Security Fairness Act. This article provides a comprehensive guide to understanding your Social Security benefits in 2025, ensuring you know when and how much you’ll receive, and what recent legislative changes mean for you.

Social Security Payment Schedule for 2025

Understanding when you’ll receive your Social Security payment is crucial for budgeting and planning. In 2025, the Social Security Administration (SSA) continues to distribute benefits on specific Wednesdays each month, based on your birth date. Here’s how it works:

- If your birth date falls between the 1st and 10th of the month, your payment is made on the second Wednesday.

- For birth dates between the 11th and 20th, payments are on the third Wednesday.

- If your birth date is between the 21st and 31st, you’ll receive your payment on the fourth Wednesday.

For June 2025, the payment dates were as follows:

| Birth Date Range | Payment Date |

|---|---|

| 1st – 10th | June 11, 2025 |

| 11th – 20th | June 18, 2025 |

| 21st – 31st | June 25, 2025 |

As of today, June 20, 2025, payments for those born on the 1st through 20th have already been disbursed, while those born on the 21st through 31st will receive their payments next week on June 25.

Additionally, Supplemental Security Income (SSI) payments, which support low-income individuals, are typically made on the 1st of each month. However, when the 1st falls on a weekend, payments are advanced to the preceding Friday. For June 2025, since June 1 was a Sunday, SSI payments were made on May 30, 2025.

Cost-of-Living Adjustment (COLA) for 2025

Each year, the SSA evaluates the need for a cost-of-living adjustment (COLA) to ensure that Social Security benefits keep pace with inflation. For 2025, the SSA announced a 2.5% COLA increase, affecting over 72.5 million Americans. This adjustment, effective from January 2025, means that the average retiree sees an additional $50 per month, raising the average monthly benefit to approximately $1,976.

This increase is automatically applied to your benefits, so you don’t need to take any action to receive it. The COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), reflecting changes in the cost of living.

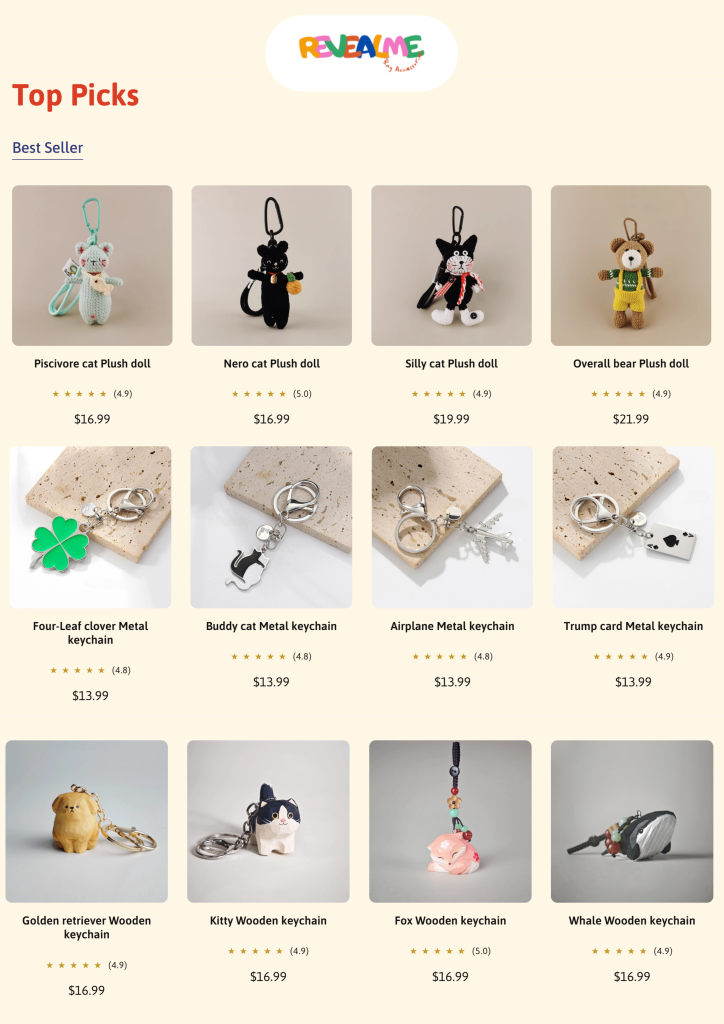

Embrace your uniqueness! ✨

(Handmade & Luxury bag accessories – Plush doll, Metal/Wooden keychain)

Shop now! – https://www.revealme.us

Supplemental Security Income (SSI) Updates

Supplemental Security Income (SSI) provides crucial support to eligible low-income individuals, including the elderly, blind, and disabled. The maximum federal SSI payment amounts are adjusted annually to account for inflation. For 2025, the SSA has set the following maximum monthly amounts:

| Category | Maximum Monthly Amount (2025) |

|---|---|

| Eligible Individual | $967 |

| Eligible Individual with Eligible Spouse | $1,450 |

| Essential Person | $484 |

It’s important to note that actual SSI payments may be less than these maximums, depending on your other income, living arrangements, and state supplements.

The Social Security Fairness Act

One of the most significant changes in 2025 is the implementation of the Social Security Fairness Act, signed into law in January 2025. This act repealed two provisions that had long been criticized for unfairly reducing Social Security benefits for certain public employees: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

Previously, WEP and GPO reduced or eliminated Social Security benefits for individuals who received pensions from jobs not covered by Social Security, such as some teachers, firefighters, and police officers. The Fairness Act eliminates these reductions, benefiting over 3.2 million Americans.

- Retroactive Payments: The SSA began issuing retroactive payments in February 2025, covering benefits from January 2024, when WEP and GPO no longer applied. By March 4, 2025, the SSA had issued over $7.5 billion in retroactive payments to more than 1.1 million people, with an average payment of $6,710. As of June 5, 2025, over 2.5 million retroactive payments had been processed, completing 90% of the caseload.

- Monthly Benefit Adjustments: Starting in April 2025, most affected beneficiaries began receiving higher monthly benefits, reflecting the elimination of WEP and GPO. These adjustments are automatic for straightforward cases, while more complex situations may require manual processing, potentially taking longer.

This legislative change has been widely discussed, with many beneficiaries expressing relief and gratitude for the increased financial support.

Tips and FAQs

To help you navigate your Social Security benefits, here are some practical tips and answers to frequently asked questions:

- How can I check my payment status? Log into your My Social Security account on the SSA website to view your payment history and upcoming payments.

- What if I haven’t received my payment? If your payment is late, wait at least three mailing days before contacting the SSA. You can call their toll-free number at 1-800-772-1213.

- Am I eligible for retroactive payments under the Fairness Act? If you were affected by WEP or GPO, you should have received a notice from the SSA regarding your eligibility and payment details.

- How do I know my exact payment date? Your payment date is based on your birth date, as outlined in the payment schedule. You can also find this information in your My Social Security account.

For more detailed information, visit the official SSA website or consult with a financial advisor.

Conclusion

In summary, Social Security payments in 2025 have seen several important updates, including a 2.5% COLA increase, adjustments to SSI payment amounts, and significant changes due to the Social Security Fairness Act. Understanding your payment schedule and the impact of these changes is crucial for effective financial planning. Stay informed by regularly checking the SSA website and your My Social Security account for the latest updates.