RTX Corporation, a powerhouse in the aerospace and defense industry, continues to shape the global market with its innovative technologies and strategic growth. With a market capitalization of $185-200 billion, RTX stands tall among competitors like Lockheed Martin and Boeing. This article explores RTX Corporation’s financial performance in Q1 2025, its competitive market position, recent developments, challenges, and future growth prospects—optimized to answer your top Google search queries about this industry leader.

Introduction: Why RTX Corporation Matters

RTX Corporation, formerly Raytheon Technologies, is a multinational conglomerate headquartered in Arlington, Virginia. Born from the 2020 merger of United Technologies Corporation (UTC) and Raytheon Company, RTX rebranded in 2023 and has since become a cornerstone of the aerospace and defense sector. Its portfolio spans commercial aviation, military systems, and cutting-edge technologies, making it a key player in both civilian and defense markets.

Whether you’re an investor, a professional in the aerospace industry, or simply curious about RTX’s trajectory, this article provides a detailed breakdown of its latest achievements and hurdles.

Financial Performance: Q1 2025 Results Signal Strength

Key Financial Metrics

RTX Corporation kicked off 2025 with robust financials, reflecting its ability to thrive amid economic shifts:

- Sales: $20.3 billion, up 5% from Q1 2024.

- Adjusted EPS: $1.47, a 10% increase from $1.34 in the prior year.

- Backlog: $217 billion, showcasing a pipeline of future revenue.

Cash flow also saw significant gains, with operating cash flow reaching $1.305 billion (up from $342 million in Q1 2024) and free cash flow climbing to $792 million (from a negative $125 million).

2025 Full-Year Forecast

Looking ahead, RTX projects:

- Adjusted Sales: $83.0-84.0 billion.

- Adjusted EPS: $6.00-6.15.

- Free Cash Flow: $7.0-7.5 billion.

With organic sales growth expected at 4-6%, RTX’s financial outlook remains promising, driven by demand in both aerospace and defense segments.

Market Position: RTX vs. Competitors

RTX Corporation’s market cap of $185-200 billion dwarfs many of its peers, cementing its dominance in the aerospace and defense industry. Here’s how it stacks up:

| Company | Market Cap Range ($B) |

|---|---|

| RTX Corporation | 185-200 |

| Lockheed Martin | 110-114 |

| Boeing | 150 |

| Northrop Grumman | 70 |

RTX’s edge lies in its diversified operations across three core segments:

- Collins Aerospace: Avionics and aerospace systems.

- Pratt & Whitney: High-performance aircraft engines.

- Raytheon: Advanced defense technologies.

This diversity allows RTX to weather market fluctuations better than competitors with narrower focuses, such as Boeing’s commercial aviation emphasis or Lockheed Martin’s defense-centric model.

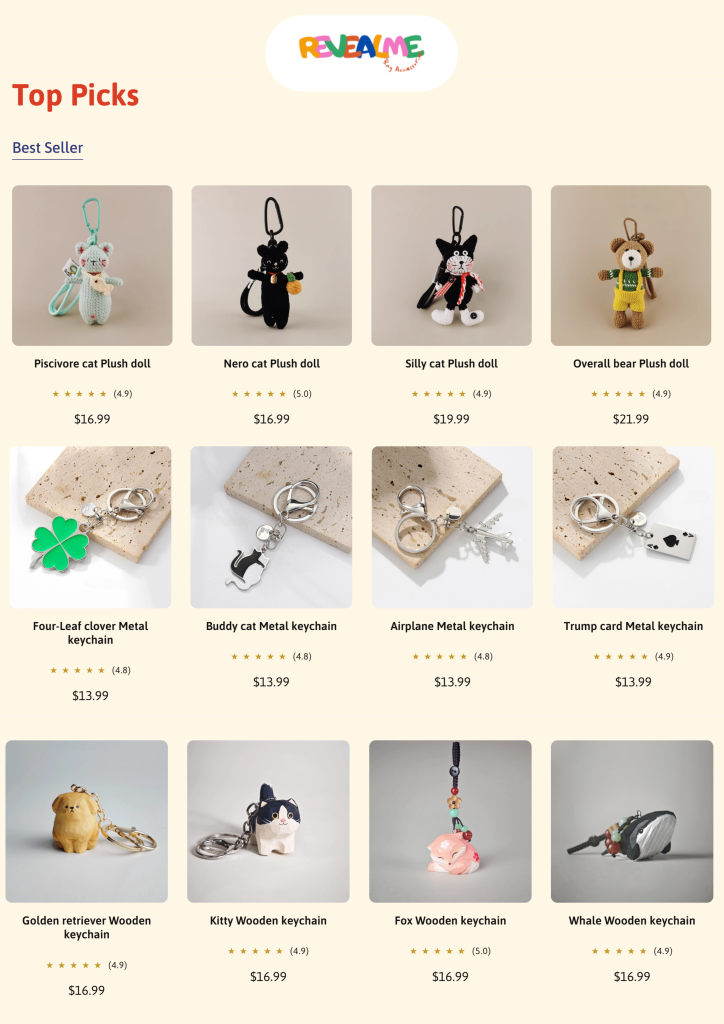

Embrace your uniqueness! ✨

(Handmade & Luxury bag accessories – Plush doll, Metal/Wooden keychain)

Shop now! – https://www.revealme.us

Recent Developments: $646 Million Navy Contract and Beyond

In June 2025, RTX’s Raytheon segment landed a $646 million contract to supply AN/SPY-6(V) radars to the U.S. Navy, part of a potential $3 billion deal over five years. This win highlights RTX’s pivotal role in meeting rising defense needs amid global tensions, including conflicts in the Middle East.

The company’s stock hit record highs in 2025, fueled by this contract and broader demand for missile systems and radar technologies. These developments position RTX as a go-to provider for governments seeking to bolster their military capabilities.

Challenges: Legal Fines and Public Backlash

RTX Corporation isn’t without its struggles. The company has faced significant legal and reputational challenges:

Regulatory Penalties

- August 2024: RTX paid a $200 million fine for violating the International Traffic in Arms Regulations (ITAR).

- Federal Settlements: The company shelled out over $950 million to resolve investigations into bribery and export control issues.

These penalties could strain RTX’s finances and international partnerships, requiring careful management moving forward.

Social Controversy

RTX has also drawn criticism for its role in supplying weapons to Israel during the Gaza war. Protests in 2023 and 2024 spotlighted the company’s defense contracts, raising ethical questions that may impact its public image and investor confidence.

Growth Prospects: Opportunities on the Horizon

RTX Corporation is poised to capitalize on two major industry trends:

- Commercial Aerospace Boom: Post-pandemic travel demand has boosted sales for Pratt & Whitney engines and Collins Aerospace aftermarket services.

- Defense Spending Surge: Geopolitical instability has governments worldwide increasing military budgets, benefiting Raytheon’s offerings.

With a projected 4-6% organic sales growth in 2025, RTX’s future looks bright—provided it can navigate its legal and social challenges effectively.

Conclusion: RTX’s Balancing Act

RTX Corporation remains a titan in aerospace and defense, blending financial strength, market leadership, and strategic innovation. Its Q1 2025 performance, massive backlog, and recent contracts underscore its potential, yet legal fines and controversies pose risks to its trajectory. For investors and industry watchers, RTX offers a compelling mix of opportunity and complexity.

What’s Your Take? How do you see RTX Corporation’s future unfolding? Drop a comment below and share this article to keep the discussion going!