Explore our in-depth analysis of Hanmi Semiconductor, a global leader in HBM equipment for AI, and uncover its strong financials and growth outlook.

1. Company Profile

Founded in 1980, Hanmi Semiconductor has evolved from a modest South Korean startup into a global powerhouse in semiconductor equipment. Based in Incheon, South Korea, Hanmi specializes in back-end semiconductor processes like assembly and packaging. According to Pitchbook, the company holds the largest worldwide market share in sewing and placement systems—a testament to its technical prowess.

Hanmi’s mission? To be a world-class semiconductor manufacturer driven by innovation and quality (SEMI). With around 500 employees and an estimated revenue of KRW 350 billion (~USD 269 million) in 2023, Hanmi serves over 300 customers globally, including heavyweights like Taiwan’s ASE (Forbes). Its reputation for excellence makes it a trusted name in this high-stakes industry.

2. Products & Services

Hanmi’s product lineup is both diverse and cutting-edge, fueling its success in the semiconductor world. Here’s what they bring to the table:

- Bonders

- Laser marking, ablation, and cutting equipment

- Vision placement and inspection systems

- Micro SAW and meta grinders

- EMI shield equipment

- Pick and place systems

- Equipment for photovoltaic (PV) and LED applications

Lately, Hanmi has zeroed in on high-bandwidth memory (HBM) equipment—think products like the GRIFFIN, DRAGON, and the newly launched DUAL TC BONDER TIGER. These are designed specifically for AI semiconductors, a red-hot market (EMIS). While exact revenue breakdowns aren’t public, the semiconductor equipment segment dominates, with laser applications and PV/LED products rounding out the mix.

What sets Hanmi apart? Its leadership in sewing and placement systems and its timely focus on HBM tech, perfectly aligned with the explosive growth of AI and high-performance computing.

3. Strategic Direction

The semiconductor landscape is shifting fast, and Hanmi is keeping pace with a bold strategy. In the near term, the company is pushing into the U.S. market with its latest HBM equipment, like the DUAL TC BONDER TIGER, to meet soaring demand for AI technologies. Looking further ahead, Hanmi aims to cement its role in next-generation computing through advanced packaging solutions and precision manufacturing.

Key moves include:

- Launching HBM-focused products

- Expanding into high-growth markets

- Investing heavily in R&D for laser tech and PV/LED equipment

This forward-thinking, innovation-driven approach positions Hanmi to ride the wave of industry trends like AI and quantum computing.

4. Industry Landscape

The semiconductor equipment market is booming, with projections to hit USD 139 billion by 2026 (SEMI). What’s fueling this growth? A few key trends:

- Extreme ultraviolet (EUV) lithography advancements

- Rising AI adoption in manufacturing

- A push for sustainability and localized production to strengthen supply chains

Regulatory factors like environmental standards and trade policies, plus economic drivers like global growth and currency shifts, also play a role. Analysts forecast a 9.2% CAGR through 2037 (Research Nester), and Hanmi’s HBM focus puts it in prime position to cash in on this upward trend.

5. Competitive Analysis

Hanmi isn’t alone in this space—it squares off against giants like ASM Pacific Technology Ltd (ASMPT) and KLA Corporation. Here’s how it stacks up:

- Market Share: Hanmi dominates sewing and placement systems, while ASMPT excels in assembly/packaging and KLA leads in process control.

- Revenue Growth: Hanmi’s steady 5-10% annual growth holds its own; KLA posted 13.94% in 2023 (TradingView).

- Profit Margin: Hanmi’s estimated 25-30% margin is solid, rivaling KLA (~30%) and outpacing ASMPT (~20%).

- Innovation: Hanmi’s HBM focus gives it an edge in AI markets, compared to ASMPT’s advanced packaging and KLA’s wafer inspection strengths.

While Hanmi shines in its niche, it trails in overall scale and global reach (Pitchbook – ASMPT). Still, its specialized HBM offerings make it a formidable contender.

6. Financial & Valuation Analysis

Hanmi’s financials tell a story of stability and growth. Over the past three years, the company has notched a revenue CAGR of 5-10%, and its pivot to high-margin HBM products promises even better profitability ahead.

6.1 Financial Snapshot

| Year | Revenue (KRW billions) | Net Income (KRW billions) |

|---|---|---|

| 2021 | 373.17 | 104.44 |

| 2022 | 327.59 | 92.26 |

| 2023 | 350 (est.) | 100 (est.) |

Trends:

- Revenue growth: ~5-10% CAGR

- Profitability: Margins on the rise

- Leverage: Debt and cash details pending

6.2 Stock Metrics

- Price: ₩108,300.00

- Market Cap: 3,462,000,000,000 KRW

7. Leadership & Employee review

In the fast-moving semiconductor world, strong leadership is non-negotiable. Hanmi’s management team, with its emphasis on innovation and market expansion, is up to the task. The company’s governance framework—spanning its board and shareholder policies—ensures accountability and strategic oversight (LinkedIn).

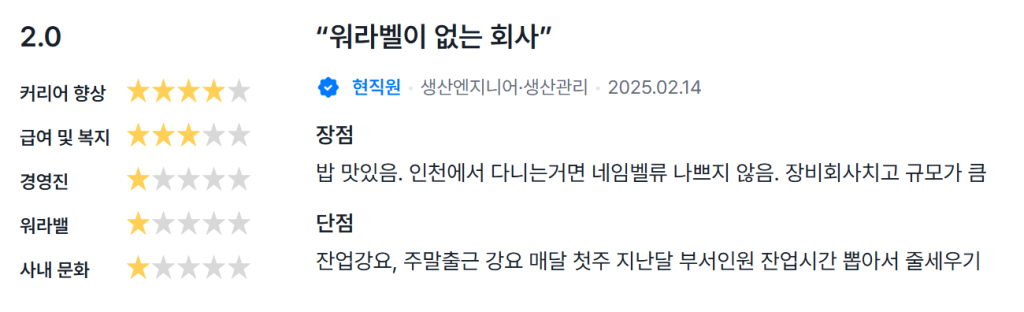

Pros:

The food is delicious. If you commute from Incheon, the company’s name value isn’t bad. For an equipment company, it’s pretty large-scale.

Cons:

Forced overtime, forced weekend work. Every month, after the first week, they pull the previous month’s overtime hours for the department staff and rank them.

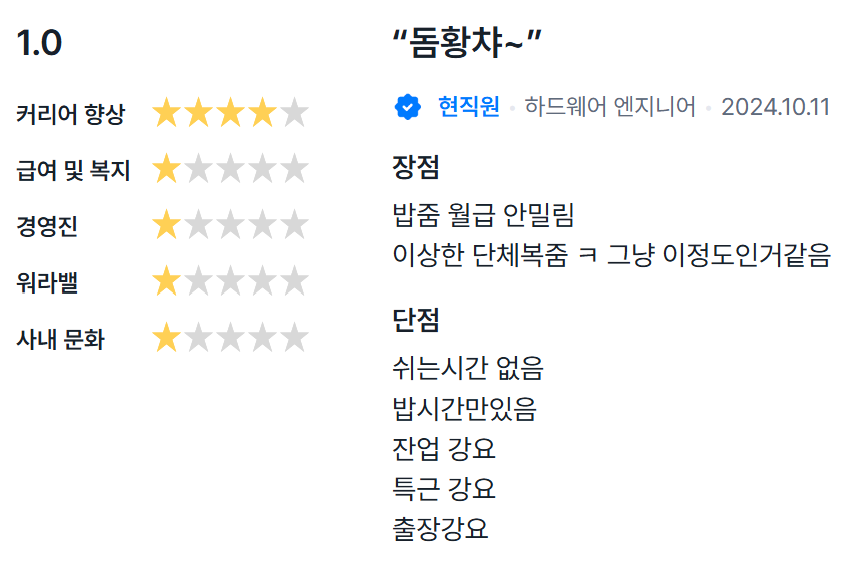

Pros:

They provide meals, and the salary isn’t delayed.

They give you weird group uniforms, lol, but that’s about it, I guess.

Cons:

No break time.

Only meal time is provided.

Forced overtime.

Forced special shifts (e.g., weekend or holiday work).

Forced business trips.

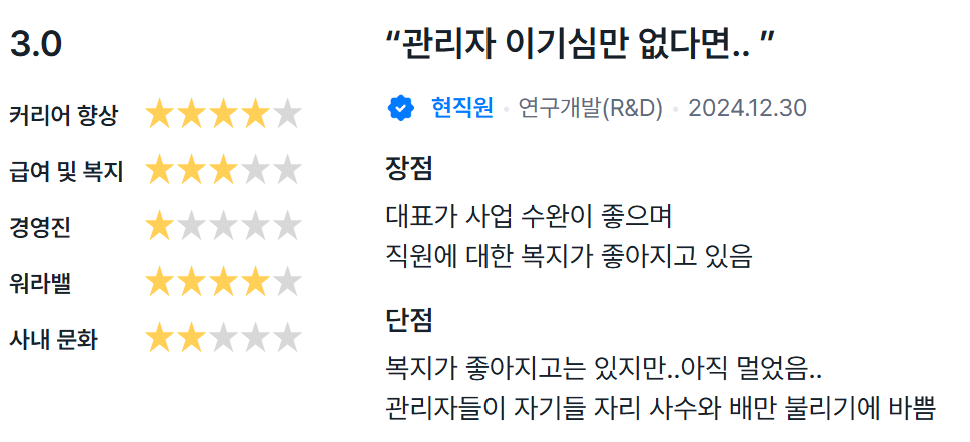

Pros:

The CEO has good business acumen.

Employee welfare is improving.

Cons:

Although welfare is getting better… it’s still a long way off.

Managers are busy securing their own positions and filling their own pockets.

8. Recent News

Hanmi’s latest move—the launch of the DUAL TC BONDER TIGER—shows its dedication to powering the AI revolution with HBM equipment. Add to that a 2018 contract worth KRW 3.04 billion with ASE (Reuters), and it’s clear Hanmi’s momentum is building. These developments signal a bright future.

(https://www.reuters.com/article/business/media-telecom/hanmi-semiconductor-signs-contract-worth-3-04-bln-won-idUSL3N1QV1WZ/)

9. Conclusion

SWOT Analysis

- Strengths: HBM leadership, loyal customer base, solid financials.

- Weaknesses: Exposure to semiconductor cycles, smaller scale vs. rivals.

- Opportunities: AI-driven demand, new market expansion, tech innovation.

- Threats: Economic slowdowns, disruptive tech shifts.

Risks

Market volatility, currency swings, and regulatory changes pose challenges. Hanmi counters these with diversification and ongoing R&D.

Outlook

Analysts see 15% revenue growth over the next three years, fueled by industry tailwinds.