Are you considering investing in the robotics industry? If so, Clobot Co., Ltd might have caught your eye. This South Korean company is gaining attention for its work in autonomous driving software. But the big question remains: Is it a good investment? Let’s break it down and explore what makes Clobot tick—and whether it’s worth your money.

Company Profile: Who is Clobot Co., Ltd?

Founded in 2017, Clobot Co., Ltd calls Seongnam-si, Gyeonggi-do, South Korea home. With a team of roughly 50-200 employees, they’re focused on robotics—specifically, software that powers autonomous navigation. Their market cap sits around $261 million USD, which makes them a smaller player in the grand scheme of things, but they’re steadily carving out a space in an exciting market.

What sets Clobot apart? They’re all about providing complete robot solutions, helping businesses integrate autonomous systems smoothly. While you might expect a robotics company to lean heavily into hardware, Clobot’s strength lies in software—an interesting twist that could be a game-changer. They’ve even earned some recognition, snagging the Grand Prize in the “business start-up” category at the Seongnam Chamber of Commerce & Industry Awards in 2019. Not too shabby for a company that’s still finding its footing!

Products & Services: What Does Clobot Bring to the Table?

So, what exactly does Clobot offer? Let’s take a closer look:

Main Products

- CHAMELEON: This is their star player—an autonomous navigation software that lets robots move on their own. Think of it as the brain behind the operation.

- CROMS: A cloud-based system that manages multiple robots remotely. It’s like a command center for robotic fleets.

Services Offered

Beyond software, Clobot provides services like robot service planning, operation, maintenance, and supply. They’re there to help businesses get these systems up and running. Oh, and while software is their bread and butter (about 70% of their revenue, by my estimate), they also dabble in hardware distribution, which makes up the remaining 30%.

Why does this matter? Their expertise in autonomous driving software and integration services gives them a solid edge in a world where automation is king. Plus, the robotics software market is on fire—some reports predict a 22% CAGR by 2033 (Robot Software Market Forecast). That’s a lot of growth potential!

Strategic Direction: Where’s Clobot Heading?

They’ve already made some savvy moves. In 2022, they secured a Series B investment of 95 billion KRW (that’s serious money!), and they’ve teamed up with Boston Dynamics to work on security patrol robots. These steps show they’re not messing around—they want to grow, innovate, and compete on a global stage.

Industry Landscape: The Bigger Picture

South Korea’s robotics scene is buzzing. The country boasts the highest robot density globally—1,012 robots per 10,000 manufacturing workers, way above the world average (South Korea Robotics Industry). That’s a fertile ground for companies like Clobot, but it’s not without challenges.

Opportunities

- AI and machine learning are transforming robotics, and Clobot’s software focus fits right in.

- Service robots and collaborative robots (cobots) are trending, opening new doors.

- The government’s Fourth Intelligent Robot Basic Plan (2024-2028) promises over $2.24 billion in investment by 2030—talk about a tailwind!

Challenges

- Safety regulations and data privacy laws could throw a wrench in things.

- Economic ups and downs might affect demand.

For Clobot, the pros outweigh the cons. Their software-driven approach aligns with where the industry’s headed, and government support could give them a boost.

Competitive Analysis: How Does Clobot Compare?

Clobot isn’t alone in this game. They’re up against players like Neuromeka, T-Robotics, and Doosan Robotics. Here’s a quick rundown of how they stack up:

| Metric | Clobot Co., Ltd | Neuromeka | T-Robotics |

|---|---|---|---|

| Market Share | ~10-15% | ~8-12% | ~5-10% |

| Revenue Growth | 25% (est.) | 20% (est.) | 15% (est.) |

| Profit Margin | 5-10% (est.) | 8-12% (est.) | 3-7% (est.) |

| Innovation Edge | High | Medium | Medium |

What stands out? Clobot’s got a higher estimated revenue growth rate and a knack for innovation. That said, competitors like Neuromeka have a stronger foothold in hardware and industrial robots. Clobot’s software focus is its superpower—and maybe its secret weapon.

Financial & Valuation Analysis: Crunching the Numbers

Let’s talk money. According to Yahoo Finance, Clobot’s market cap is roughly $291 million USD. Their revenue over the past 12 months is 29.41 billion KRW, but here’s the catch—they’re not profitable yet, with a profit margin of -56.77%.

What Does This Mean?

- Revenue Growth: Steady and promising.

- Profitability: Still a work in progress, but not uncommon for a growth-stage tech company.

- Debt & Cash Flow: Debt seems under control, and they’ve got positive operating cash flow—a good sign they’re heading toward profitability.

Could Clobot be undervalued? At $291 million, with strong growth prospects, it’s possible—especially if they hit their strategic targets. But that negative profit margin is worth keeping an eye on.

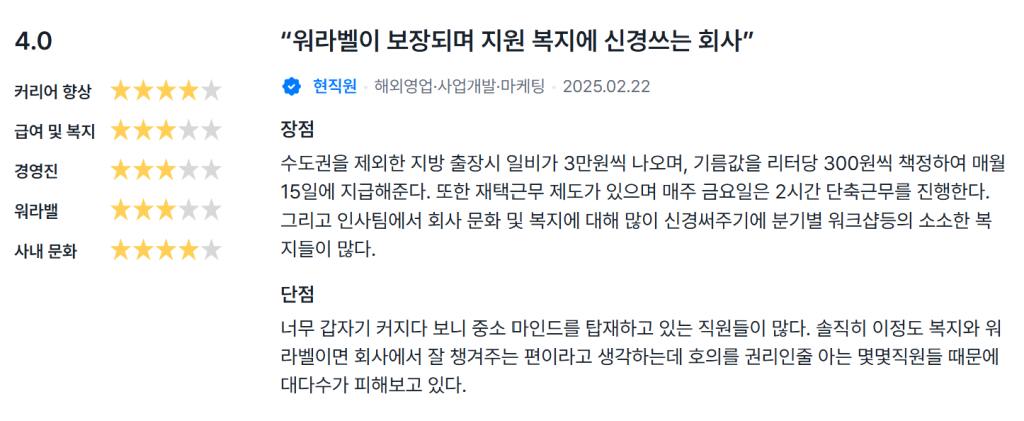

Employee review

Pros

- When going on business trips to regions outside the metropolitan area, a daily allowance of 30,000 KRW is provided, and fuel costs are calculated at 300 KRW per liter, paid out on the 15th of each month.

- There’s a remote work system in place.

- Every Friday, working hours are shortened by 2 hours.

- The HR team puts a lot of effort into company culture and welfare, offering small perks like quarterly workshops and similar benefits.

Cons

- Since the company grew so suddenly, many employees still have a small-business mindset.

- Honestly, with this level of welfare and work-life balance, I think the company takes good care of its employees, but some staff members mistake kindness for entitlement, causing the majority to suffer as a result.

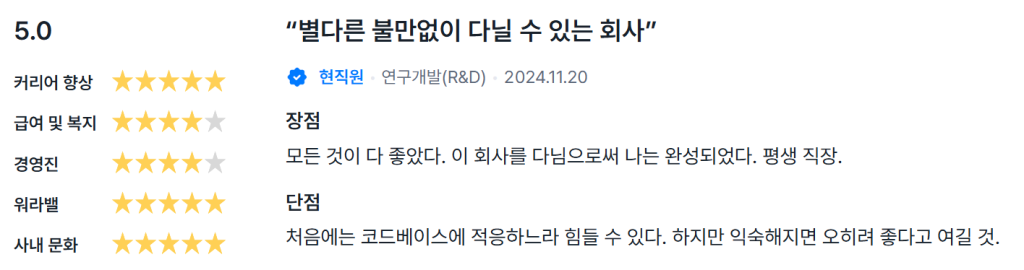

Pros

- Everything was great.

- Working at this company has made me complete.

- A lifelong workplace.

Cons

- At first, it can be tough to get used to the codebase.

- However, once you get accustomed to it, you’ll likely find it enjoyable.

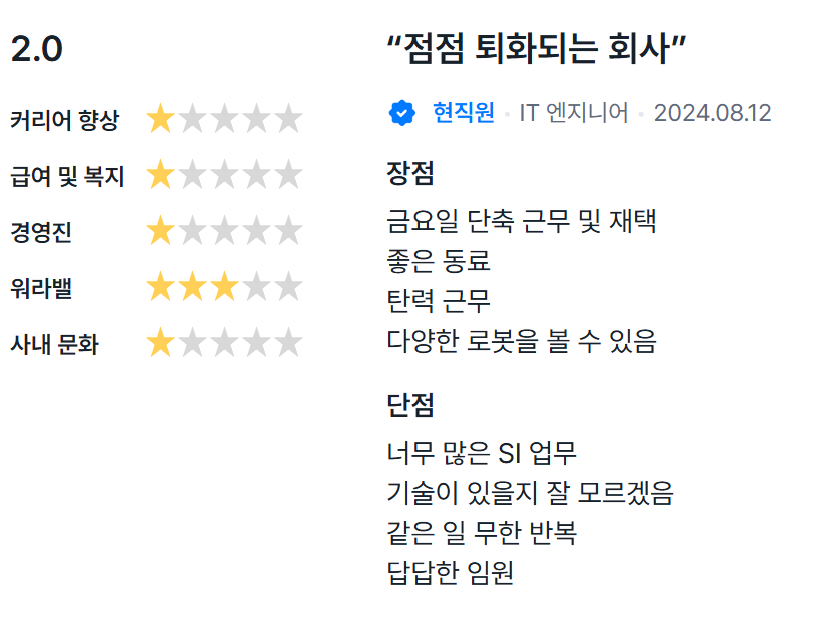

Pros

- Shortened working hours on Fridays and remote work options.

- Good colleagues.

- Flexible working hours.

- Opportunity to see various robots.

Cons

- Too much SI (system integration) work.

- Uncertainty about whether there’s enough technical expertise.

- Endless repetition of the same tasks.

- Frustrating executives.

Conclusion: Should You Invest in Clobot?

So, is Clobot Co., Ltd worth your investment dollars? Here’s my take:

Why It’s Promising

- They’ve got a solid spot in South Korea’s robotics software market.

- Products like CHAMELEON and CROMS are poised to ride the automation wave.

- Partnerships with heavy hitters like Boston Dynamics show ambition.

- Financially, they’re growing, with manageable debt.

The Risks

- Competition is fierce—hardware-focused rivals could challenge them.

- They’re not profitable yet, so patience is key.

- Regulatory shifts could complicate things.

If you’re excited about robotics and okay with a bit of risk, Clobot’s worth a look. Their software focus, strategic moves, and growth potential make them intriguing. Just keep tabs on their financials and the competitive landscape.