Creative & Innovative System Corp (CIS), based in Daegu, South Korea, delivers advanced secondary battery electrode equipment, driving EV battery innovation.

Welcome to our in-depth investment analysis of Creative & Innovative System Corp.(“CIS”) In this article, we’ll explore the company’s background, product lineup, market opportunities, financial performance, and more. If you’re an investor looking for insights into the rapidly growing secondary battery industry, read on to discover why CIS might be an attractive addition to your portfolio.

1. Company Overview

Creative & Innovative System Corp (“CIS”) is a South Korean company headquartered in Daegu, specializing in secondary battery electrode equipment. The firm has carved out a strong presence in the global market, thanks to its advanced technology and robust client base. CIS focuses on designing and manufacturing core process equipment used in producing electric vehicle (EV) batteries and energy storage systems (ESS).

2. Main Products & Services

씨아이에스’s main expertise lies in secondary battery electrode equipment, which is essential in manufacturing batteries for electric vehicles and energy storage applications. Their range of advanced equipment primarily covers:

- Coating Systems

- Drying Equipment

- Pressing Machinery

A standout example is their “hybrid drying coater”, which leverages laser drying technology to enhance production efficiency significantly. This innovative solution boosts productivity and minimizes power consumption, giving CIS a competitive edge in the market.

3. Growth Strategy

CIS is committed to a multi-pronged growth strategy focusing on technological innovation, geographical expansion, and strategic acquisitions. Below are the key elements of their approach:

- Technological Advancement

- The company continuously innovates and refines its electrode equipment.

- The newly launched hybrid drying coater combines laser drying technology to double production speed while cutting power consumption by nearly half.

- Expansion into New Markets

- CIS is actively extending its global footprint in North America and Europe.

- Recent contracts with major battery manufacturers in these regions contribute to robust revenue growth.

- Strategic Acquisitions

- CIS completed a merger with SNU Precision, known for its display and semiconductor inspection and measurement equipment.

- This acquisition diversifies CIS’s portfolio and opens opportunities for technological synergies.

- Focus on All-Solid-State Batteries

- CIS invests heavily in R&D for all-solid-state batteries, an emerging next-generation technology with high potential in EVs and ESS.

- Signing NDAs with automakers in Japan and Europe signals the company’s commitment to pioneering this transformative technology.

4. Industry Trends

The secondary battery industry is on a fast-growth trajectory, spurred by the rising adoption of electric vehicles and the need for large-scale energy storage. Below are key trends that could significantly impact CIS:

- Surge in Electric Vehicle Demand

- Worldwide transition to EVs, bolstered by supportive government policies, fuels demand for advanced battery solutions.

- Expansion of Energy Storage Systems

- The shift to renewable energy requires efficient storage solutions, where secondary batteries play a pivotal role.

- Continuous Technological Advancements

- Ongoing R&D focuses on improving battery performance, safety, and cost. CIS’s commitment to innovation positions it favorably in this environment.

- Rise of Automation

- Automated manufacturing processes are critical for reducing costs and enhancing efficiency. CIS’s specialized automated electrode equipment meets this growing need.

- Integration with Smart Meters and IoT

- As utilities adopt smart meters and IoT devices, there’s a surge in data generation that must be managed effectively.

- CIS can potentially tap into this data-centric trend by offering integrated solutions that address the data management needs of utility companies.

5. Comparison with Competitors

Although the provided research material does not offer an exhaustive competitor analysis, 씨아이에스 operates in a market shared by both global tech giants (e.g., Oracle, IBM, SAP) and specialized equipment manufacturers. Here’s a snapshot of potential competitors in battery equipment:

- Hirano Tecseed (Japan): Focuses on coating and drying machinery for lithium-ion batteries.

- PNE Solution (Korea): Offers a wide array of battery manufacturing equipment, including electrode fabrication solutions.

- Youil Energy Tech (Korea): Specializes in equipment for lithium-ion battery electrode manufacturing.

CIS stands out through its core expertise in secondary battery electrode equipment and its focus on cutting-edge technology. Further research—especially regarding market share and product benchmarking—is recommended to gain deeper insights.

6. Analysis of Financial Statements

BReviewing the quarterly financial data from June 2022 to September 2024, revenue showed a rapid increase from late 2022 to late 2023, reaching KRW 221.3 billion in December 2023.

However, operating profit turned negative in September 2024, largely due to a surge in selling and administrative expenses, and net income also demonstrated significant volatility.

Financial income and expenses fluctuated considerably from quarter to quarter, reflecting sensitivity to exchange rates and interest rates.

Overall, while CIS has achieved robust revenue growth, cost management and currency risks remain key factors that could affect future performance.

7. CEO & Employee review

Kim Dong-jin, the CEO of CIS, champions a corporate philosophy centered on continuous innovation and technical excellence. Under his leadership, the company aims to:

- Develop new-concept equipment for the secondary battery industry.

- Secure next-generation battery technologies (e.g., all-solid-state batteries).

- Strengthen CIS’s global leadership in battery electrode equipment.

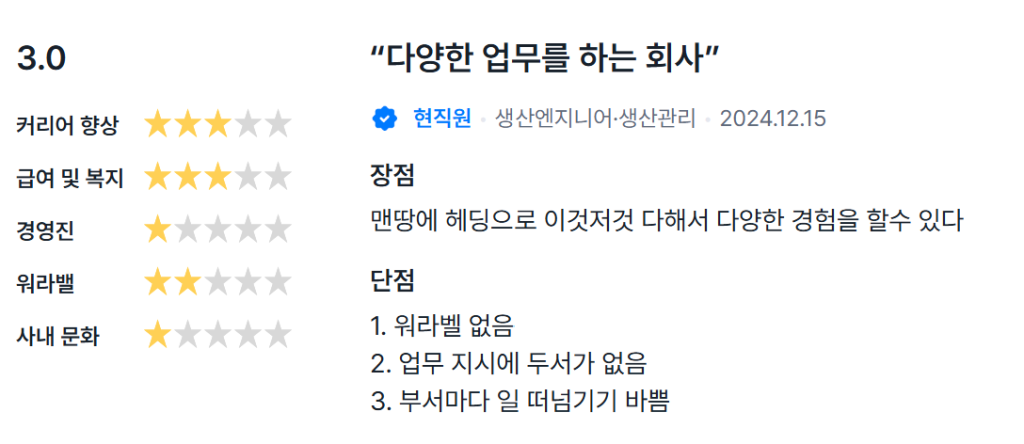

Pros

- You gain a wide range of experiences by diving in headfirst and tackling everything as it comes.

Cons

- There is no work-life balance.

- Work instructions lack organization.

- Each department is busy passing work off to others.

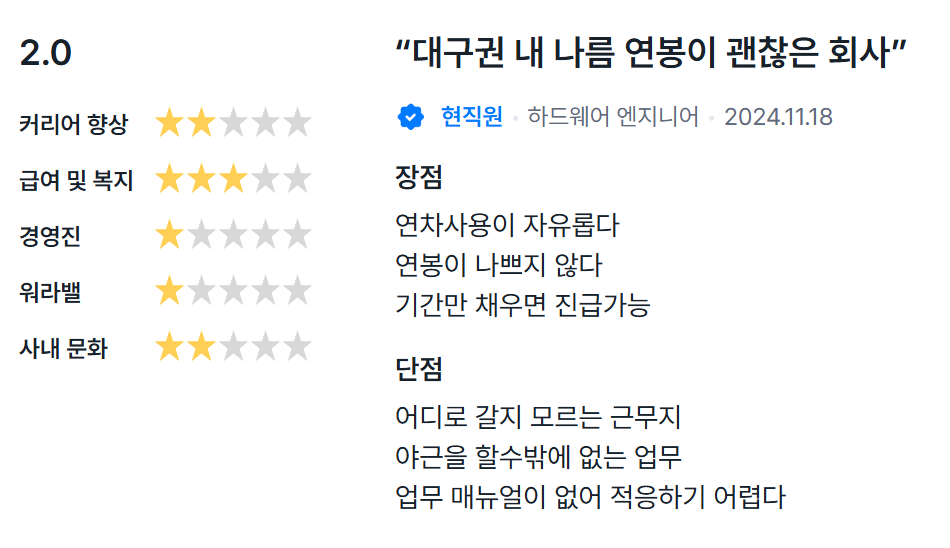

Pros

- Flexible use of annual leave

- Decent salary

- Promotion is possible as long as you meet the required tenure

Cons

- Uncertain work location

- Work that inevitably requires overtime

- No work manual, making it difficult to adapt

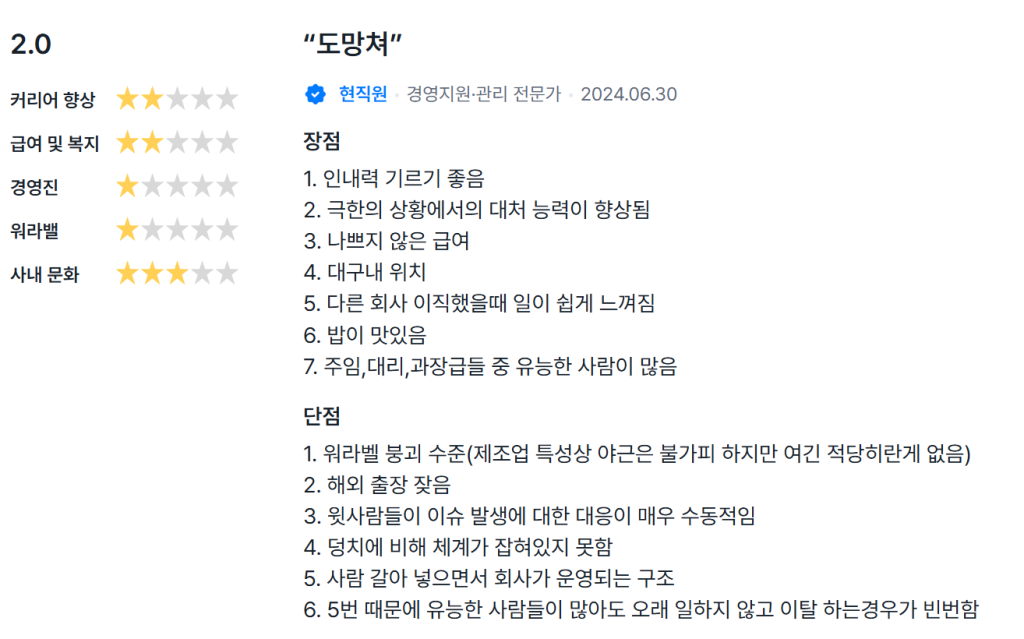

Pros

- Great for building endurance.

- Enhances your ability to handle extreme situations.

- Decent salary.

- Located in Daegu.

- When you move to another company, the work feels much easier.

- The food is delicious.

- There are many capable individuals among the junior managers, assistant managers, and managers.

Cons

- The work-life balance is completely broken (while overtime is inevitable in manufacturing, here it’s excessively so).

- Frequent overseas business trips.

- Upper management is very passive in responding to issues.

- The organizational structure isn’t well-established given the company’s size.

- The company operates by frequently rotating personnel.

- As a result of point 5, even if there are many competent people, they often leave after a short period.

8. Recent News

Recent headlines about CIS underscore its strong market performance and strategic moves:

- Record-Breaking Revenue: Achieved all-time-high revenue and operating profit, reflecting its growing clout in the battery manufacturing sector.

(https://www.eetimes.eu/cmos-image-sensors-mems-trends-and-market-perspectives) - Cutting-Edge Innovations: Continuous investment in R&D, highlighted by the successful launch of its hybrid drying coater.

(https://www.kspost.biz/news/articleView.html?idxno=289) - Global Reach: Sustained focus on entering high-potential markets like North America and Europe, forging partnerships with major international battery producers.

- Merger with SNU Precision: Enhances the company’s diversification and paves the way for new technological breakthroughs.

9. Potential Risks

Even though CIS shows strong growth potential, investors should weigh the following risks:

- Stiff Competition

- The battery electrode equipment sector is highly competitive. Maintaining pricing power and technological leadership is crucial for CIS’s market position.

- Technological Disruption

- Rapid changes in battery technologies (e.g., all-solid-state batteries) could render existing equipment obsolete. CIS must stay agile in R&D to adapt quickly.

- Macroeconomic Factors

- A global recession or decreased consumer spending on EVs and renewables could dent demand.

- Diversification across various markets and product lines can partially offset this risk.

10. Synthesis and Conclusion

In summary, Creative & Innovative System Corp (CIS) represents a promising investment opportunity in the booming secondary battery sector, driven by:

- Strong Market Position: A proven leader in secondary battery electrode equipment with an established customer network.

- Technological Edge: Commitment to innovation, particularly in laser drying technology and all-solid-state battery R&D.

- Global Expansion: Steady market penetration in North America and Europe, securing high-profile contracts.

- Strategic Acquisitions: The merger with SNU Precision adds a new dimension of expertise and diversification.

Still, prudent investors should conduct further due diligence—especially around competitive dynamics, evolving battery technologies, and detailed financials—before making a final investment decision.

Final Thoughts

If you’re looking for a company that aligns with future-facing industries such as EVs and renewable energy, CIS is a noteworthy contender. Its focus on next-generation technology, coupled with expanding market reach and rising profitability, makes it a firm to watch in the ever-growing secondary battery space