Discover AMD’s latest financial performance, stock analysis, and competitive positioning in the semiconductor industry. Learn about its strategic initiatives, SWOT analysis, and future outlook as of June 2025.

Key Takeaways:

- Strong financial growth in Q1 2025, with revenue up 36% year-over-year.

- Stock price around $130 with potential upside based on analyst targets.

- Strategic acquisitions and partnerships enhance AMD’s competitive edge.

- Geopolitical risks and competition remain key challenges.

Introduction

Advanced Micro Devices (AMD) is a leading semiconductor company known for its innovative CPUs, GPUs, and computing solutions. As of June 2025, AMD continues to make significant strides in the data center, AI, and gaming sectors. This article provides an in-depth analysis of AMD’s financial performance, stock trends, competitive positioning, and strategic initiatives, offering valuable insights for investors and industry enthusiasts.

Financial Performance: Strong Growth in Q1 2025

AMD’s financial results for Q1 2025 demonstrate robust growth, driven by its data center and client segments. The company reported revenue of $7.438 billion, a 36% increase from Q1 2024. Key highlights include:

- Data Center Segment: Revenue surged by 57% to $3.674 billion, fueled by demand for AI accelerators like the Instinct series.

- Client and Gaming Segment: Client revenue grew by 68% to $2.294 billion, while gaming revenue declined by 30% to $647 million.

- Gross Margin: Improved to 50% (GAAP) and 54% (non-GAAP).

- Net Income: Reached $709 million (GAAP) and $1.566 billion (non-GAAP).

For Q2 2025, AMD projects revenue of approximately $7.4 billion, though export controls may impact margins. Excluding these charges, the gross margin is expected to remain strong at 54%.

Related: AMD Q1 2025 Financial Results

AMD Stock Analysis: Trends and Analyst Insights

As of June 17, 2025, AMD’s stock price hovers around $130, showing recent upward momentum. Analyst price targets range from $95 to $210, with an average of $141.56, suggesting a potential 21.87% upside. The consensus rating is “Buy” from 32 analysts.

- Bullish Sentiment: Benchmark reiterated a “Buy” rating with a $170 target, citing the MI350 launch and AMD’s AI roadmap.

- Bearish Signals: Some analysts note resistance around $130-$135, with potential volatility due to market conditions.

AMD’s stock performance reflects its growth potential, though investors should monitor geopolitical risks and competition.

Related: AMD Stock Forecast and Price Targets

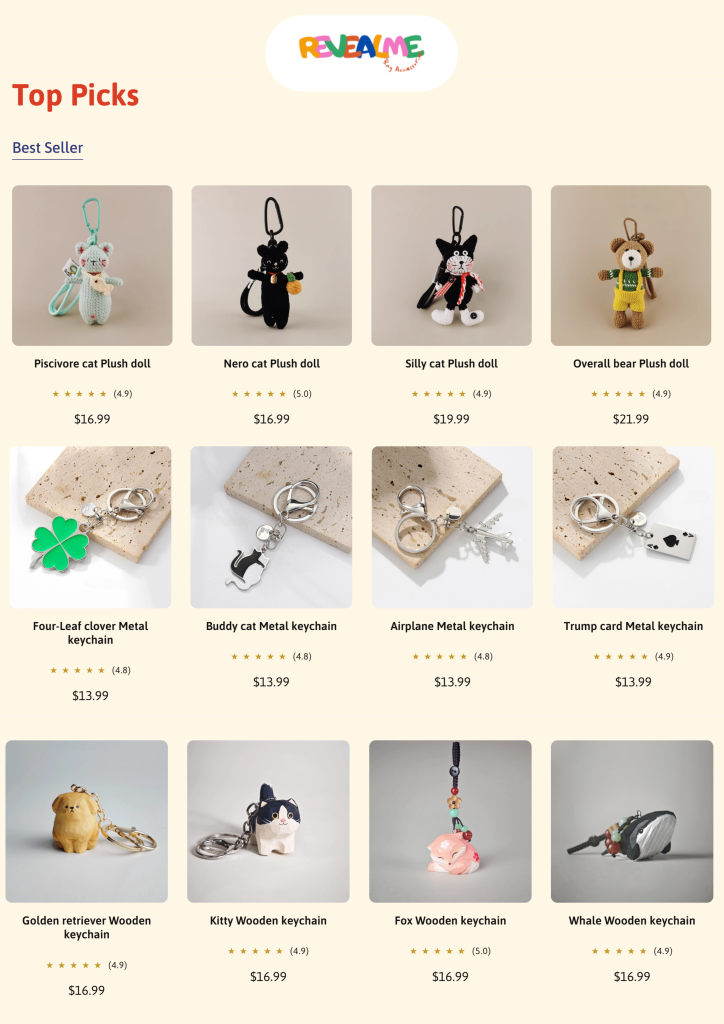

Embrace your uniqueness! ✨

(Handmade bag accessories – Plush doll, Metal/Wooden keychain)

Shop now! – https://www.revealme.us

Competitive Landscape: AMD vs. Intel and NVIDIA

AMD faces intense competition from Intel and NVIDIA, particularly in the CPU and AI GPU markets.

- CPU Market: AMD has gained market share with its Ryzen and EPYC processors, challenging Intel’s dominance.

- AI GPU Market: While NVIDIA leads, AMD’s Instinct MI300 and upcoming MI350 GPUs position it to capture growing AI infrastructure demand.

Despite these strengths, AMD must navigate challenges like export controls, which could impact $1.5 billion in revenue from China in 2025.

Related: AMD SWOT Analysis

Strategic Initiatives: Acquisitions and Partnerships

AMD has pursued strategic moves to strengthen its market position:

- Acquisition of ZT Systems: A $4.9 billion deal to enhance rack-scale solutions for AI infrastructure.

- Partnerships: Collaborations with Meta, Google, Nokia, and Jio Platforms to expand its ecosystem.

- Product Launches: The Ryzen 9 5950X3D and 5th Gen EPYC processors underscore its focus on high-performance computing and AI.

These initiatives highlight AMD’s commitment to innovation and market expansion.

SWOT Analysis: Strengths, Weaknesses, Opportunities, and Threats

A detailed SWOT analysis reveals AMD’s strategic position:

| Category | Details |

|---|---|

| Strengths | Technology leadership, strong product portfolio, global presence, intellectual property, financial performance, partnerships, market share gains, skilled leadership, competitive pricing, energy efficiency, R&D investment, fabless manufacturing, brand reputation, supply chain resilience. |

| Weaknesses | Dependence on outsourced manufacturing, intellectual property risks, competitive pressure, volatile market conditions, limited mobile presence, dependence on key customers, financial stability concerns, manufacturing constraints, supplier dependence, high R&D costs, weaker marketing, customer concentration risks, international operations challenges, narrower product line, patent expiration. |

| Opportunities | Growth in data centers, AI/ML demand, gaming/VR/AR markets, remote work solutions, collaborations, mobile processor market, emerging markets, HPC, automotive industry, IoT, software development, education sector, supply chain optimization, custom chip solutions, acquisitions, sustainability, work from home culture, intellectual property utilization, edge computing, telecommunications, blockchain. |

| Threats | Intense competition, macroeconomic challenges, lack of diversification, technological advancements, legal/regulatory challenges, global chip shortage, intellectual property disputes, price wars, exchange rate fluctuations, regulatory changes, cybersecurity threats, shifts in consumer preferences, market saturation, dependence on key customers, fabrication plant limitations, overdependence on PC market, alternative technologies, tariffs/trade tensions, environmental regulations, fluctuating demand for gaming hardware, energy costs/efficiency. |

Related: SWOT Analysis of AMD Updated 2025

Conclusion: AMD’s Future Outlook

AMD is well-positioned for future growth, leveraging its strengths in innovation and strategic focus on data centers and AI. Despite challenges from competition and geopolitical risks, its recent financial performance and stock trends suggest resilience. Investors should monitor AMD’s execution on its AI roadmap and geopolitical developments, particularly U.S.-China trade relations, for long-term prospects.